harrisburg pa local services tax

2 South Second Street. The December 2020 total local sales tax rate was also 6000.

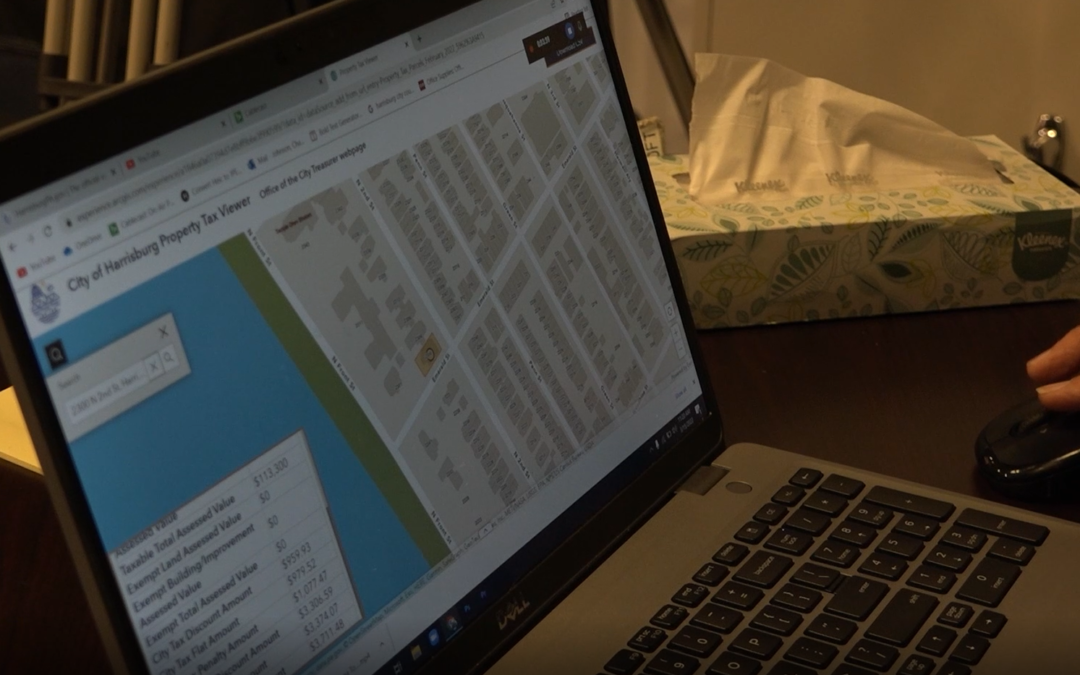

HARRISBURG A brand new interactive feature on the City of Harrisburg website put your city and school tax values one click away.

. Dan Miller City Treasurer dcmillerharrisburgpagov. The increase only applies to people who make more than 24000. Blair County Tax Collection Bureau.

Monday - Friday from 800 AM to 430 PM. Harrisburg PA Sales Tax Rate. Local Services Tax forms for Individuals.

A convenience fee of 235 for credit cards 250 for business cards and 150 for debit cards is charged. Harrisburg City SD Director. 1419 3rd Avenue PO Box 307 Duncansville PA 16635-0307.

Making tax collection efficient and easy for over 35 years. Mailing address if different. First theres the fact that the citys main employer the state government pays no property tax.

This rate includes any state county city and local sales taxes. The minimum fee is 100. Whether you are a taxpayer making a payment or a public official looking for a collection solution for your community we.

Dauphin County Office of Tax Assessment. 8391 Spring Rd Ste 3 New Bloomfield PA 17068. 8391 Spring Rd Ste 3 New Bloomfield PA 17068.

This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online. Matt Maisel Director of Communications 717 255-7295. The Property Tax Viewer available on the Harrisburg City Treasurers page on.

Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the. Please make a selection from the menu below to proceed. Pennsylvania Department of Community Economic Development Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone.

We offer user-friendly online services coupled with responsive customer support to 900 school districts and municipalities throughout Pennsylvania. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year. BRADFORD TAX COLLECTION DISTRICT.

Individual Taxpayer Mailing Addresses. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years. The name of the tax is changed to the Local Services Tax LST.

The latest sales tax rate for Harrisburg PA. A total of 156 a year to support the services I consume or might needroads police fire health inspections etcover some 2000 annual working hours seems like a fair price to pay. 22 rows The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from.

The current total local sales tax rate in Harrisburg PA is 6000. Call a customer care representative at 610 599-3139 or Contact Us. Earned Income Tax Regulations.

The tax which is deducted from the paychecks of people who work in the city is being tripled from 52 per year to 156 per year. Your Local Withholding Tax Rates HOME. This is the date when the taxpayer is liable for the new tax rate.

Earned Income Tax Regulations. The information needed to set up an account is. Local Services Tax forms for Individuals.

Each payment is processed immediately and the date is equal to the time you completed the transaction. Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

But in Harrisburg the situation is much more pressing. Links for Individual Taxpayers. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA.

FAQ for Individual Taxpayers. 47 Home News. If the total LST rate enacted exceeds 1000 the tax will be deducted at a rate of 100 per week.

Physical address of business location. BLAIR TAX COLLECTION DISTRICT. Download Employer Registration Form PDF Fax 610 588-5765 Attn.

2020 rates included for use while preparing your income tax deduction. Pennsylvanias third-class cities for the most part have only a handful of ways they can collect revenue to fund municipal services. Whether you are a taxpayer making a payment or a public official looking for a collection solution for your community we are ready to.

Dauphin County Property Info.

2717 N 4th St Harrisburg Pa 17110 Realtor Com

New Property Tax Viewer On Harrisburgpa Gov Gets You Ready For Tax Season City Of Harrisburg

2215 N 2nd St Harrisburg Pa 17110 Realtor Com

13 Fun Things To Do In Harrisburg Pa Under 30

2624 Derry St Harrisburg Pa 17111 Realtor Com

Harrisburg Needs Donations From Tax Exempt Properties Pennlive Com

323 N Front St Harrisburg Pa 17101 Realtor Com

Harrisburgpa Gov The Official Website For The City Of Harrisburg

No Tax Increases Projected Surplus Are Hallmarks Of Harrisburg S First Williams Budget Pennlive Com

Harrisburg Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Harrisburg Pa Cdl Class A Truck Driver Jobs Local Routes Hiring Now Sygma Employer Direct Hire Openings Apply Online Here Ht Truck Driver Jobs Truck Driver Cdl

Who Works In Harrisburg Our Mapping Project Shows Where Commuters Come From And Where They Re Going Theburg